Better three hours too soon than a minute too late, a popular saying which ties in perfectly with Peoplesonic’s introduction of Automated Payroll. A simple and easy to use interface, that allows for a time-efficient solution to your financing problems.

Is Your Risk Calculated?

In terms of finance and calculation, it all comes down to margins and efficiency. There’s a certain speed at which an employee can execute a task and even then the accuracy of said calculations is in doubt. Manually crunching numbers, entering data, and calculating leaves a lot to be desired from an efficiency standpoint. Similarly, as humans are incapable of perfection a few natural hiccups are inevitable.

For a small business or any business, all these factors are very much counter-intuitive. So why not opt for a ready-made solution; Peoplesonic? Payroll automation simplifies and completely revolutionizes the traditional method as it is capable of calculating a string of numbers in seconds. Calculations also include adding bonuses, taxes, and other variables that would otherwise be tedious to factor in.

Automated Payroll Gets Work Done Faster, Simpler, And More Efficient

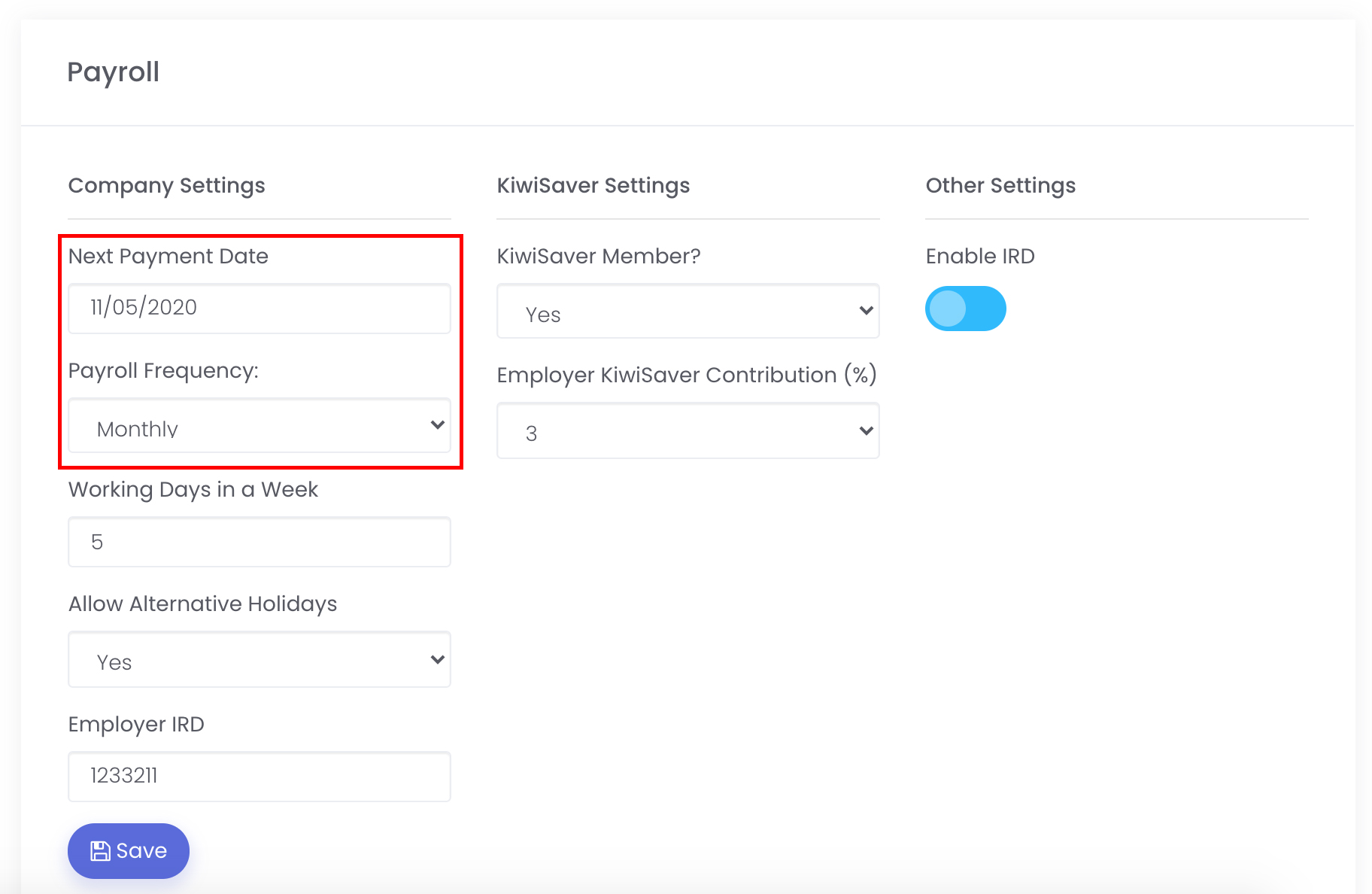

Setting up your payroll on Peoplesonic for the first time may seem daunting, however, it’s as easy as a few taps. An admin has to specify a few factors such as payroll date and frequency, which can conveniently be altered from the settings tab. It’s as simple as that, with the data entered the process will completely be automated without any errors. You’ll be able to see each payroll report and overrule any edit you wish seamlessly, every detail is just a tap away!

This will remove the need for an in-house resource to manage finances as well as a host of other features to top it all off. The software automatically transfers the funds via bank transfer online and notifies both you and the employee about the transaction. Keeping a strict check on time won’t be an issue either as the system runs very precisely on time, allowing for each transaction and process to be done on the dot. All of this will be synced and stored to keep a complete record of the process.

Organizing Your Organization With Automated Payroll Filing

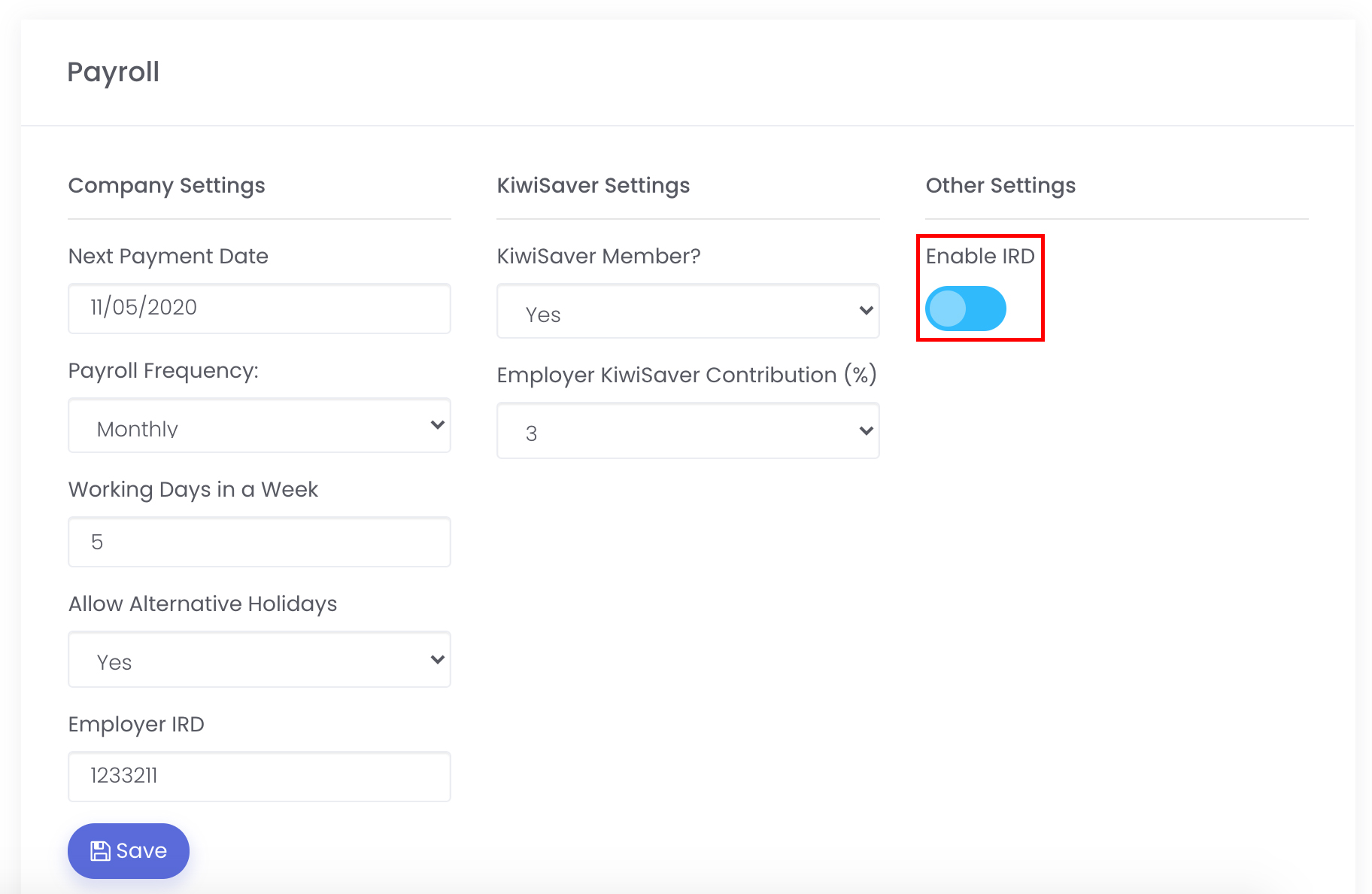

Peoplesonic completely encapsulates payroll automation, and payroll filing is no different. This feature can be activated by enabling the IRD button and linking your IRD account to the Peoplesonic system. This allows for the payroll to be optimized as per the IRD regulation and will continue to generate during its set schedule. This will allow the system to periodically maintain a tax record, and store each record as a backup. Worrying about errors won’t be an issue either, as the software is designed in a way that minimizes calculation errors and smoothly calculates your taxes.

The payroll process will no longer require human interaction or handling per se, the system will reliably produce results in an effective manner. The filing system will store and manage data, generating folders to organize as it goes forward. This will facilitate you due to its timely processing and simple interface. Convenience and efficiency all in one system!

Make Changes With A Few Clicks

One of the points of using an automated system is the ability to customize and alter any components to suit your needs. Similarly, the payroll allows for edits to be made anytime. Any edit will quickly be updated and the relevant changes will be showcased after a quick refresh! Adding a new employee is a prime example, another would be to change bank account details. If any detail is incorrect or does not have a correct value, it will be highlighted and not processed to reduce errors. This allows you to have full control over the system despite it running independently.

Peoplesonic’s entire interface runs on the same easy on the eye aesthetic which helps you navigate seamlessly.

Maintaining Employee Satisfaction

Although being an automated system, the boost in employee satisfaction is vast. The interface allows users to request and access files/libraries much more easily and even has the benefit of displaying remaining leaves etc. This allows the employees to stay in check and aids in the management side as a constant check is not necessary. It guarantees each change is made to the server at the earliest providing for a smooth and productive experience. Employees will be notified if they arrive late or have exhausted all of their leaves and paid leaves, a detailed report of each user is available to keep the financing transparent.

The software removes the guesswork for the employer and keeps the employees in the loop, allowing for an overall efficient system.

Efficient On Time and Money

Normally HR-related tasks are carried out by an assigned team member, which exhausts the human in question, countless resources, and more importantly time. An in-house HR manager may have its perks, but it’s clear the heavy amounts of money and time do not add up. However, a feature-rich solution allows you to carry out multiple tasks within a finger’s reach and a few taps here and there. So a well-optimized payroll system carries out your tasks while eliminating human errors, and automates your problem into the all-around solution you need!